Advertiser Disclosure

A few of the loan providers and connectors noted on these pages have affiliate links. We utilize affiliate links therefore we can protect the expenses of keeping the website and keep researching each connector or lender. Thank you for understanding.

Observe that quantities and terms may vary by states and loan provider.

We would also like to really make it specific our company is not really a loan provider. We cannot make loan or credit choices nor broker loans. This web sites aim would be to notify site visitors of feasible loan providers and connector. If somebody as an example telephone calls you saying they have been representing us and will be offering you that loan, it is 100percent a fraud. Hang up the phone straight.

Many thanks for scanning this notice that is short!

Exactly why are guaranteed in full installment loans lenders that are direct difficult to get?

With regards to researching assured installment loans direct loan providers only, this informative article covers all of it. We shall touch regarding the advantages, kinds, and factors when shopping for loans. First, let’s clean up some misconceptions.

There’s no thing that is such a assured installment loan. Though some direct loan providers come near since they have actually low approval requirements, it is impossible they are able to “guarantee” acceptance. By way of example, loan providers with free needs https://speedyloan.net/payday-loans-ky will reject people that probably cannot show their earnings.

Having said that, installment loans have become ever more popular. Individuals can secure the income they want in just a couple of hours without leaving house. Many lenders demand a easy application and some financial details. Prospective borrowers will even need to deposit security, such as for instance a regular wage or individual home, to secure the mortgage.

Most useful “guaranteed” Installment Loans direct loan providers and connectors

About guaranteed installment loans

Installment loans include borrowing a lump amount of cash and paying the mortgage amounts right back incrementally. Individuals can borrow the maximum amount of cash because they require, around a limitation, unlike revolving credit. Revolving credit, like this for charge cards and company personal lines of credit, immediately renews after a person pays off their debts.

The payment on installment loans happens more than a period that is fixed. The payments are generally due at the conclusion of the thirty days, although date that is due vary in line with the loan provider. Each repayment is called an installment, thus the name. A few examples of installment loans consist of mortgages and loans that are personal.

The advantage of direct loan provider installment loans for bad credit is the fact that the payment procedure is predictable. Borrowers can budget their repayments while accounting for almost any changes that are unexpected. After making the ultimate repayment, the borrowers’ financial obligation vanishes.

What makes installment loans a lot better than pay day loans?

Among the advantages of an installment loan is the fact that borrowers can buy additional money. When buying a house, the installment loan will soon be thousands of bucks. Conversely, payday advances are fairly tiny and are also typically $100 to $1,000 in value.

The greater money value makes installment loans well suited for long-lasting funding. Whether purchasing a property, vehicle, or any other significant item, individuals should buy them straight away and pay off the financial institution in the long run. As a result of the repayment that is extensive, the attention price for installment loans is gloomier compared to pay day loans.

Moreover, installment loans are simpler to refinance. If borrowers wish to get a far better interest term and rate, the method is easy. While refinancing pay day loans is feasible, it really is less frequent, and, in certain states, it isn’t available.

Simple tips to always check and enhance your credit history

The step that is first increasing a credit history is to find a credit file. Individuals will get a free of charge content of these credit history through the three major credit agencies: TransUnion, Experian, and Equifax. Browse www. Annualcreditreport.com or phone 1 (877) 322-8228 for free copy.

Next, correct any mistakes in the credit history. Credit reporting agencies have obligation that is legal investigate inaccuracies from the credit file. These errors could be detrimental to someone’s general rating, with typical errors including misspelled names, misattributed credit records, and information from a previous partner or spouse.

People should attempt to repay any debt that is existing whether which from student education loans, charge cards, or bills. Lenders value people who possess minimal debt burden. Whilst it might not be feasible to get rid of your debt, reducing the sum that is overall a good way toward increasing their credit utilization ratio.

Will there be such a thing such as for instance a installment that is monthly without any credit check?

Regrettably there are not any month-to-month installment loans no credit check always direct loan providers. But even when a loan provider do some variety of credit check their requirement could be suprisingly low. Some just need a income that is monthly of800 pre-tax.

Points to consider with installment loans

Installment loans allow individuals pay back expenses that are significant trade for long-lasting debt. Even though the payment procedure is incremental, lacking a solitary repayment can produce more financial obligation. This is the reason it’s critical to take into account the stipulations before putting pen to paper.

Installment loans might have features just like pay day loans, such as for instance higher rates of interest and brief payment durations. People who have dismal credit records may struggle under these conditions. Plus, a person’s credit rating will drop also further when they default.

While installment loans aren’t that is inherently“good “bad, ” people should take time to give consideration to all issues with the offer. As an example, interest levels can determine exactly how viable paying down that loan is in the offered time frame. Using these facets under consideration means focusing on how much a customer will need to effortlessly spend to borrow funds.

Overview: fully guaranteed installment loans lenders that are direct

The predictability of installment loans means they are a safer choice than pay day loans. Individuals may even utilize them to combine financial obligation as a solitary repayment. The borrower’s funds and requirements will determine the conditions regarding the loan, along with the prospective provides.

There’s no right path to take about locating a assured installment loan for bad credit or even a direct loan provider. Having said that, it really is into the interest that is best of customers to obtain quotes from numerous sources. While this procedure may be frustrating, it permits visitors to quickly compare prices, and also leverage one loan provider against another.

It’s also critically essential to comprehend the stipulations before signing. Remember to buy into the offer that the direct loan provider has established in order to avoid any undesired surprises later on. Doing research on the internet and looking into resources, like the Better Business Bureau, will give individuals a significant understanding of the credibility and standing of a business.

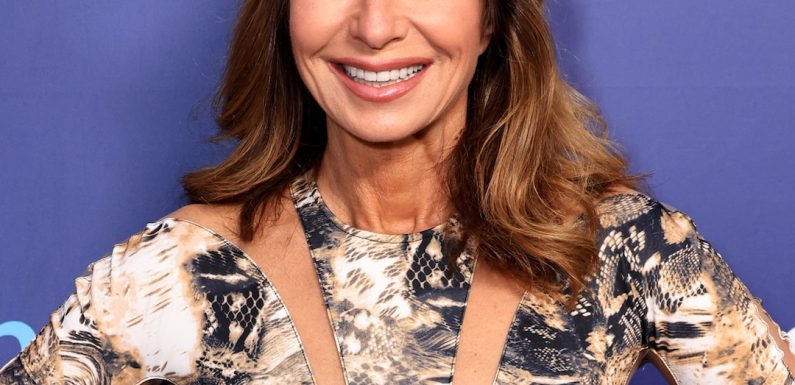

Joseph Smith Writer and editor

Joseph Smith can be an experienced freelance journalist with more than 11 many years of experience. Their part of expertise includes finance, loans and lending. Their work happens to be showcased on different big web sites including that one. Read more about united states »